Did you know that you could be saving thousands of dollars simply by claiming depreciation for an investment property?

Unfortunately 80 per cent of investors are simply unaware of the deductions available for the structure of a building (capital works) and the easily removable plant and equipment assets contained within an investment property.

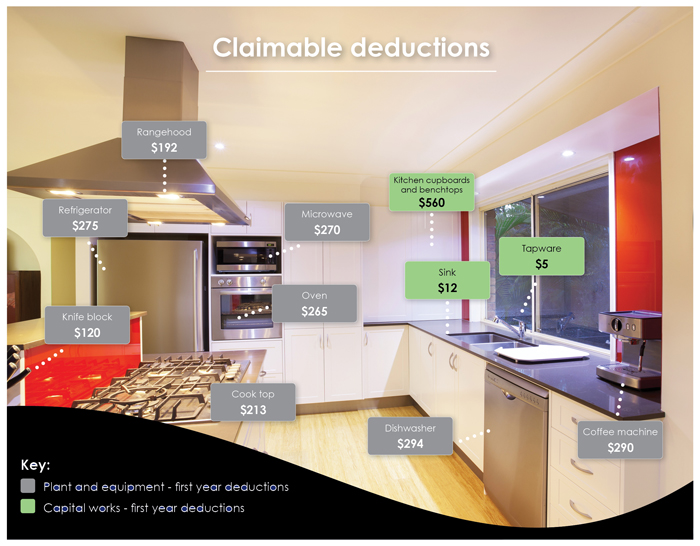

The following example shows just some of the items an investor can claim depreciation deductions for within the kitchen of their investment property.

As the image displays, an investor could claim around $1,919 in depreciation deductions for the plant and equipment assets and around $577 in capital works deductions in the first financial year alone for items contained in this kitchen.

Of course, depreciation is not limited to just the kitchen of an investment property. Capital works deductions can be found for the walls, doors, roof and fixed structures of any property in which construction commenced after the 15th of September 1987.

It is worth noting that even if a property was constructed prior to 1987, there may be still be capital works deductions available for any new structural items that have been added within the legislated dates. This is the case even if a renovation was completed by the previous owner of the property.

Unlike capital works, depreciation for plant and equipment items is not restricted by legislated dates, rather the individual quality and depreciable life of the assets found within the property. Examples of some of the other depreciable assets found throughout an investment property include door closers, garbage bins, air conditioning units and hot water systems.

On average, investors can claim between $5,000 and $10,000 in the first financial year in depreciation deductions for an investment property.

To find out what depreciation deductions can be claimed for any investment property it is recommended to speak with a specialist today.